The price action is either a continuation or a reversal of a preceding dominant trend, depending on the timeframe you’re trading. With continuation chart patterns, you can identify momentary pauses in a market trend, allowing you to set up your positions before the trend continues. One such pattern is the flag chart pattern. We’ll explain how the flag pattern is formed and how you can trade with the bull and bear flag.

What is the Flag Chart Pattern?

The flag chart pattern is a trend continuation pattern that often appears when there’s a sustained trend in the market (bullish or bearish) followed by a period of consolidation. Since it’s a continuation pattern, you may take advantage of the consolidation period when the flag pattern forms before the price breaks out.

How to Identify a Flag Pattern

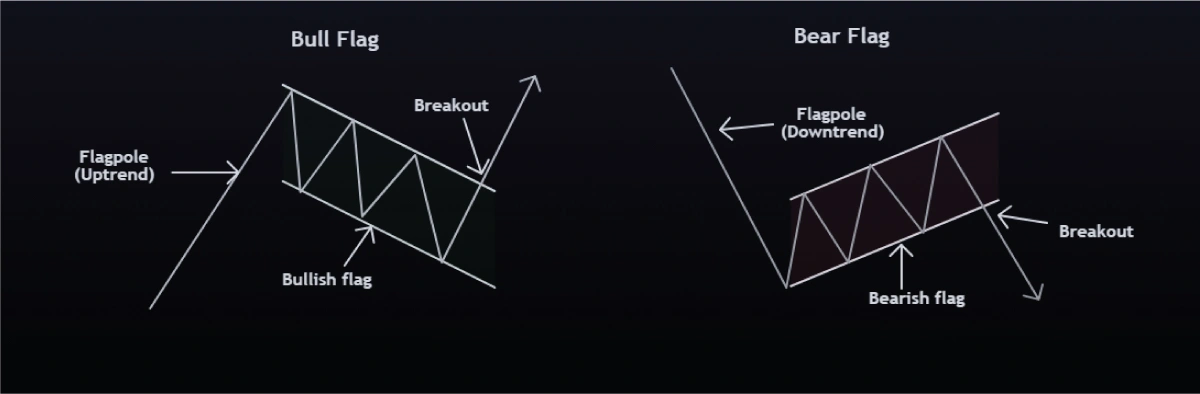

The flag chart pattern gets its name because it resembles an actual flag. Here’s how you can identify it:

Step 1: Identify the flagpole (the dominant trend)

The flagpole corresponds with strong bullish or bearish market momentum. Ideally, this trend should be driven by higher volumes.

Step 2: The consolidation phase

The preceding momentum transitions into a consolidation phase, marked by a pause in the trend and a drop in the volume traded. Typically, this period is relatively short-lived, and the flag pattern formed here comes in all shapes and sizes. It could be a horizontal price range, a slight pullback forming a downward channel in a bull flag, and an upward channel in a bear flag. During this phase, traders are waiting for the break out of the consolidation.

Step 3: Identify the Support and Resistance Levels

Trading the flag pattern involves a breakout strategy, so you must identify the pattern’s support and resistance levels. The flag’s upper level formed during the consolidation phase is the resistance, and the lower level is the support.

Step 4: The Breakout: Trend Continuation

Depending on your trading strategies, a breakout occurs when the price breaks above the resistance or below the support. An increase in the volume must accompany a breakout. That’s because traders usually take advantage of the consolidation phase to take positions in the market in anticipation of the breakout.

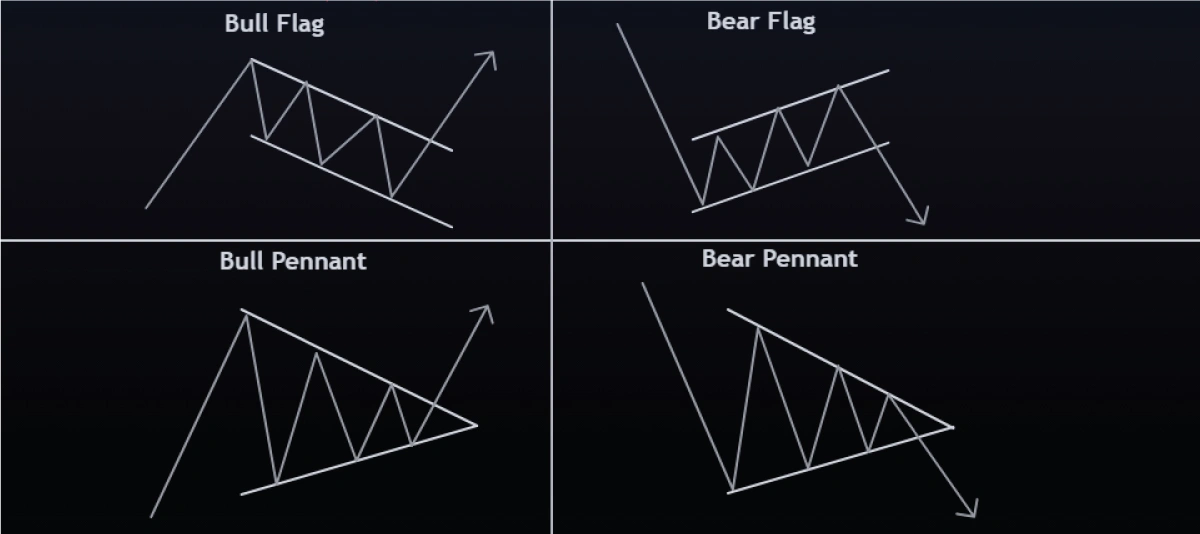

Flag Pattern vs Pennant Chart Pattern

It’s not uncommon to see the flag and pennant chart patterns mentioned alongside each other. The formation of these two patterns is almost identical, with the only difference being the shape taken during the consolidation phase. The flag chart pattern has nearly parallel support and resistance trend lines, while pennants have converging support and resistance trend lines.

This is the only difference between the flag and pennant pattern. The trading strategy for a bullish flag and bullish pennant is the same as that for a bearish flag and bearish pennant patterns.

Here’s a visual representation of a bull and bear flag vs. bull and bear pennants.

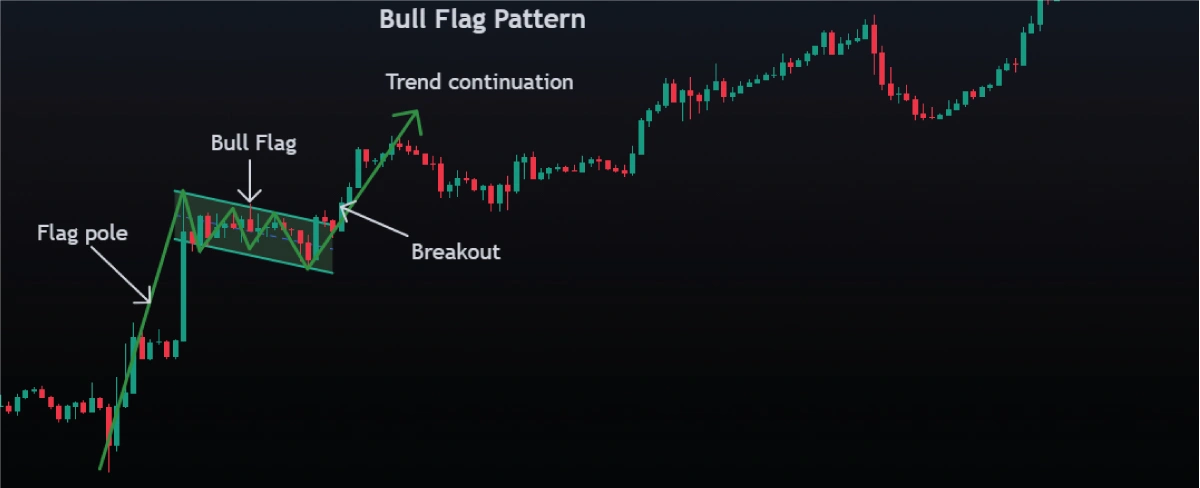

What is a Bull Flag Pattern?

A bull flag is a bullish continuation chart pattern. It forms when there’s a sharp uptrend followed by a relatively brief consolidation period and a bullish breakout. An increase in the volume must drive the initial bullish trend traded, and the pullback should have a corresponding drop in volume. Finally, the resulting breakout above the flag’s resistance must be driven by increased volume.

In a bull flag pattern, the flag is often a short-term price pullback, and the price doesn’t retrace more than 50% of the flagpole. There’s a higher chance of trend reversal if the pullback covers the entire flagpole.

How to Trade the Bull Flag Pattern

Since a bull flag is a bullish continuation chart pattern, the potential entry for a long position is after a breakout above the resistance. Note that if the price breaks above the resistance and closes below it, it implies that there isn’t enough bullish momentum to push the prices further. The price should break and close above the flag’s upper trendline for an ideal setup. You can set the stop loss below the flag’s support. The rationale is that a break below the support could signal a trend reversal.

When setting the profits target, you can peg it on the prevailing market volatility using the ATR indicator. Alternatively, you can put it at the equivalent of the pattern’s flagpole.

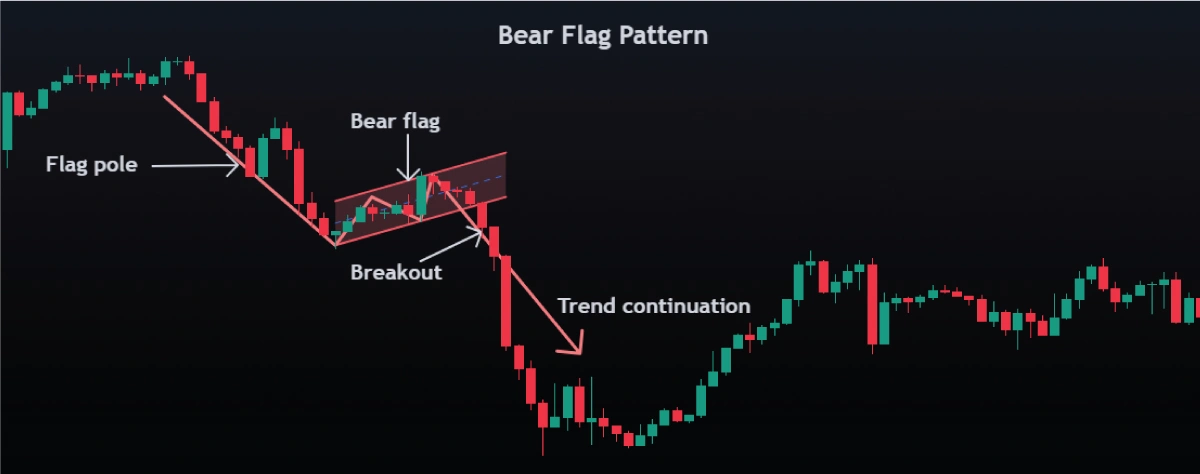

What is a Bear Flag Pattern?

A bear flag is a bearish continuation chart pattern. It looks like an inverted bull flag pattern and forms when there’s a sharp downtrend followed by a relatively brief consolidation period and a bearish breakout. Like with the bull flag pattern, the initial bearish trend must be driven by an increase in the volume traded, with a drop in the volume during the consolidation phase. The resulting breakout below the flag’s supports must also be accompanied by increased volume.

When trading a bearish flag pattern, the pullback during the consolidation phase must not exceed 50% of the initial bearish trend. If it does, there’s a high probability of a trend reversal.

How to Trade the Bear Flag Pattern

Given that a bear flag is a bearish continuation chart pattern, the potential entry for a short position is after a breakout below the flag’s support.

Depending on the timeframe you’re trading, if the price drops below the support but fails to close below it, it implies that there isn’t enough short-selling momentum. In this case, always wait for the price to break and close below the flag’s support.

You can set the stop loss above the flag’s resistance. A pullback above the resistance after a bearish breakout could signal a trend reversal. As for the profits target, you can peg it on the prevailing market volatility using the ATR indicator. Alternatively, you can set it at the equivalent of the pattern’s flagpole.

The Bottom Line

In price action trading, bull and bear flags are bullish and bearish trend continuation chart patterns, respectively. They form after a relatively short-lived consolidation period after a sustained bullish or bearish trend. The consolidation phase is followed by a breakout confirming the trend continuation. When trading the bull flag, a bullish trend continuation is confirmed by a breakout above the flag’s resistance. A bear flag confirms a bearish trend continuation by a breakout below the flag’s support.

Volume plays a key role in the formation of a flag pattern. The initial trend that forms the flagpole must be driven by a sustained increase in the volume traded, followed by a subsequent drop in the volume during the consolidation phase. Finally, the breakout for the pattern continuation must be driven by a resurgence in higher volume. We put such a big emphasis on context and volume because volume leads price, so when change in volume supports the chart patterns, it increases the probability of a trend continuation. The more traders act on the pattern, the more it becomes a self-fulfilling prophecy.

Remember, patterns are not strategies until we merge them with rules, markets, setups, and trade plans, as shown in this guide.